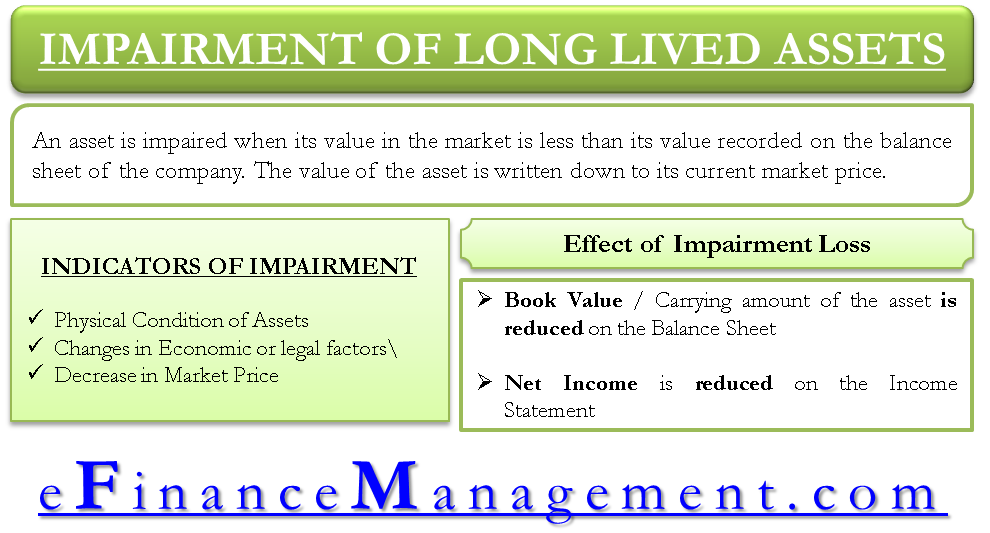

An impairment loss is not reversed merely due to the passage of time ie. Fair value less costs to sell of assets held for sale may exceed the assets carrying amounts either at the initial classification date or on subsequent remeasurement under IFRS 5.

Ias 36 Example Of The Reversal Of Impairment Youtube

IAS 36124 Disclosure Disclosure by class of assets.

. Its recoverable amount if determinable. Reversal of impairment is a situation where a company can declare an asset to be valuable where it has previously been declared a liability. The impairment loss to be reversed is calculated as follows.

And the carrying amount. And to reverse that impairment by say 400 simply undo the impairing entry Dr Asset Account 400 Cr Revaluation Reserve 400 There is a bit of a problem here because when reversing an impairment we should not give an asset account an adjusted value greater than it would have been if we hadnt impaired it in the first place. The indicators used to determine if an impairment can be reversed are similar those used to evaluate the initial impairment loss.

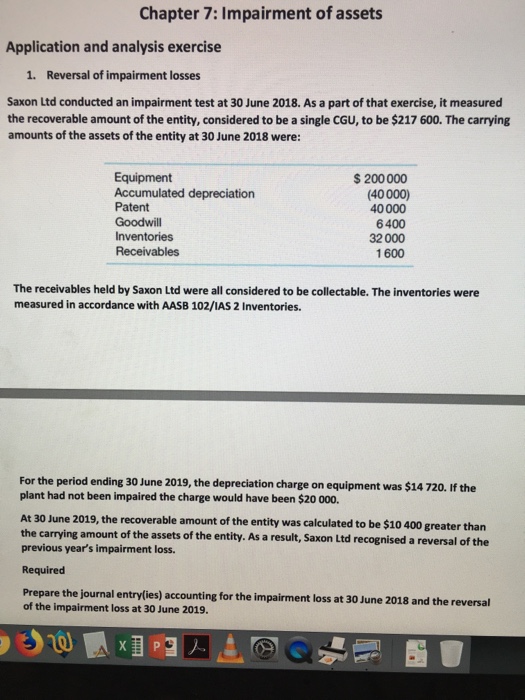

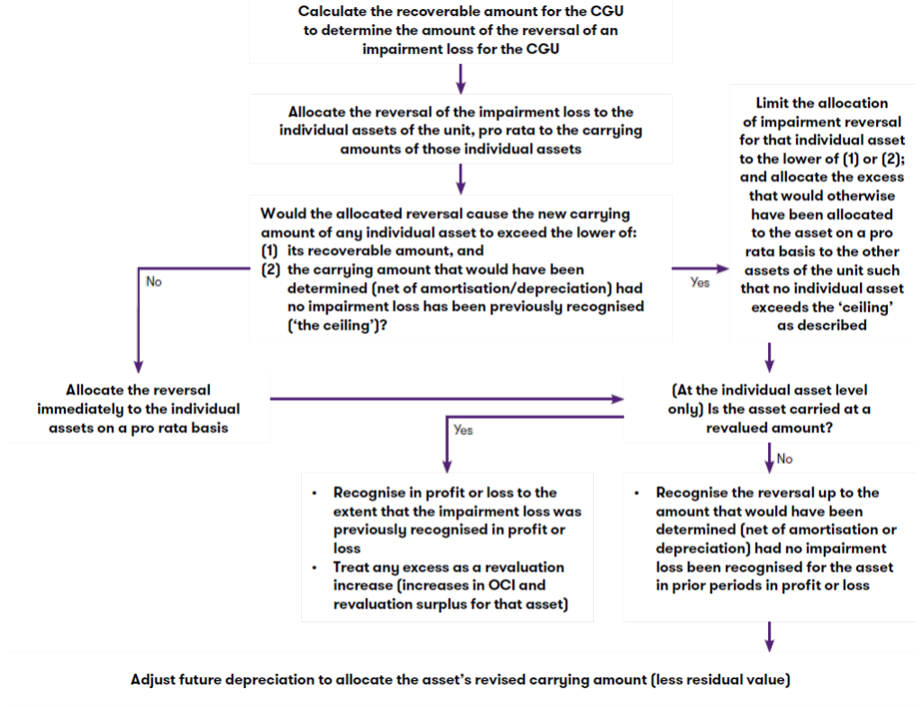

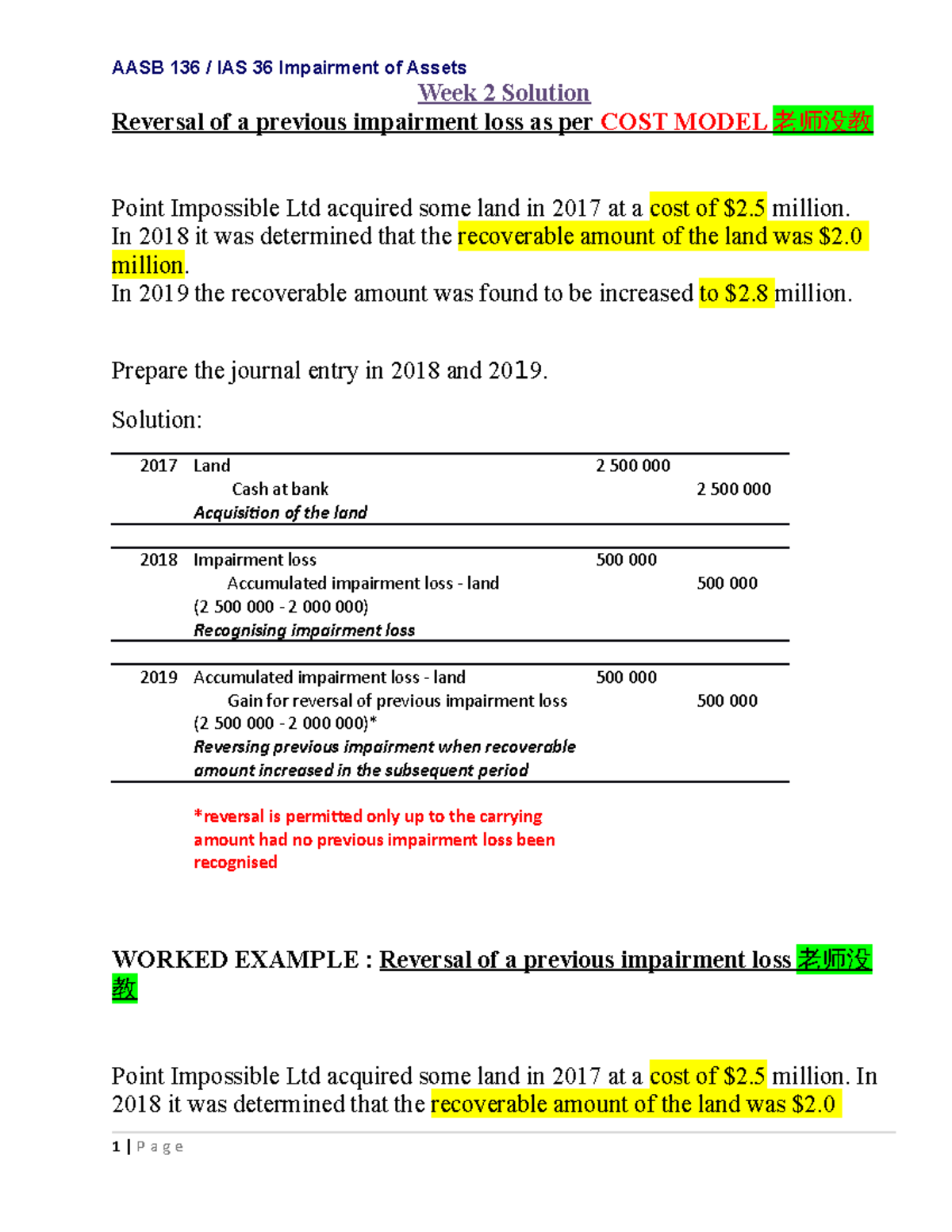

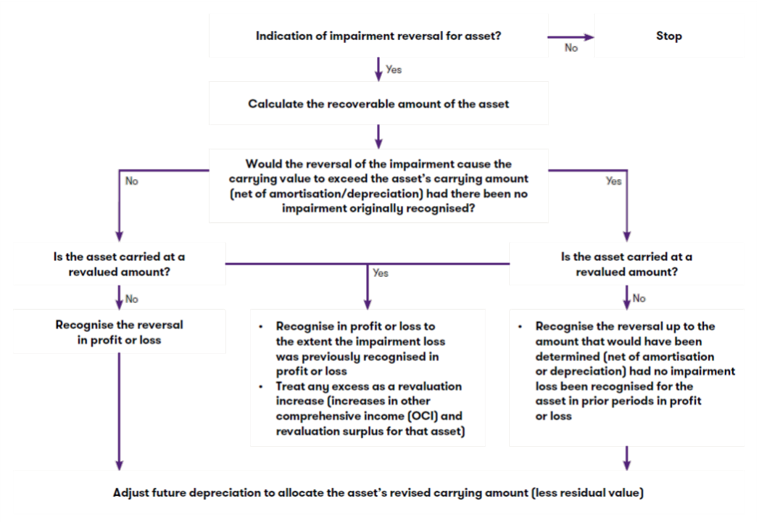

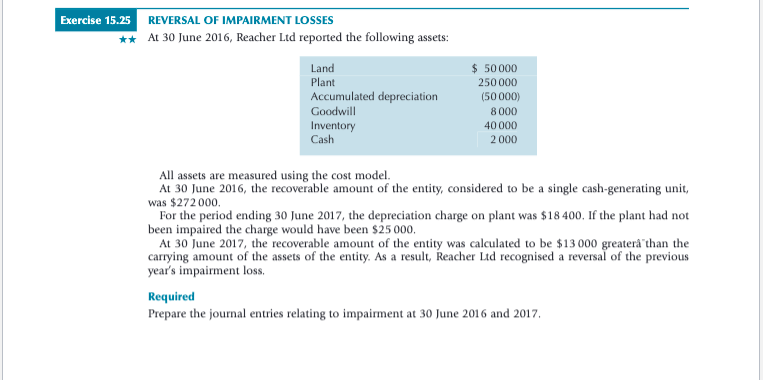

The impairment loss should be reversed but only to the extent that it does not exceed the carrying amount that would have been determined had no impairment loss been recognised in prior years aasb 136 para 117 hence reverse the prior impairment loss of 300000accumulated impairment losses land dr 300000 reversal of impairment loss cr. A reversal of an impairment loss reflects an increase in the estimated service potential of an asset either from use or from sale since the date when an entity last recognised an impairment loss for that asset. To reverse an impairment loss the estimated service potential of the asset or CGU either from its use or from its sale must have improved since the company impaired the asset.

Changes in market values Interest rate changes Physical damage Changes in use New competition etc. Reversal of an impairment loss is recognized in the profit or loss unless it relates to a revalued asset. Recoverable amount is more than the historical net book value.

Consistent with other IFRS impairment guidance IFRS 15 requires impairment losses to be reversed in certain circumstances similar to the existing standard on impairment of assets. Impairment Loss Reversal Historical Net Book Value - Net Book Value. The potential gain does not.

Reversal of an impairment loss is recognised in the profit or loss unless it relates to a revalued asset IAS 36119 Adjust depreciation for future periods. The reversal of an impairment loss reflects an increase in the estimated service potential of an asset either from use or from sale since the date when an entity last recognised the impairment loss for the asset. Reversal of impairment losses of a disposal groups assets occurs when an asset held for sale is impaired but then revalues as follows.

In these circumstances the entity may need to record a gain arising from the reversal of previous impairment losses but with the following conditions. You can reverse an impairment loss only when there is a change in the estimates used to determine the assets recoverable amount. It means that you cannot reverse an impairment loss due to passage of time or unwinding the discount.

An entity must identify the change in estimate that causes the increase in estimated service potential. Rather any expected recoveries in future cash flows are reflected as a prospective yield adjustment. There are times however when this situation changes and the asset becomes valuable.

When the increase in the recoverable amount is caused only by unwinding the discount. An impairment loss recorded under IAS 36 prior to the held for sale classification or under IFRS 5 at or after the. IAS 36 para 115.

Impairment losses are either recognized through the cost model or the revaluation model depending on whether the debited amount was changed through the new adjusted fair market valuation. Reversals of impairment losses for debt securities classified as available-for-sale or held-to-maturity securities are prohibited. An enterprise is required to identify the change in estimates that causes the increase in estimated service potential.

123 In allocating a reversal of an impairment loss for a cash-generating unit in accordance with paragraph 122 the carrying amount of an asset shall not be increased above the lower of. Recoverable amount is less than the historical net book value. A reversal of an impairment loss reflects an increase in the estimated service potential of an asset either from use or sale since the date when an enterprise last recognised an impairment loss for that asset.

In general asset impairment indicates that an asset costs more to a business than it is worth. Impairment loss Reversal Recoverable Amount - Net Book Value. IAS 36121 Reversal of an impairment loss for goodwill is prohibited.

Accounting For Property Plant And Equipment Reversal Of Impairment Loss Part 1 Youtube

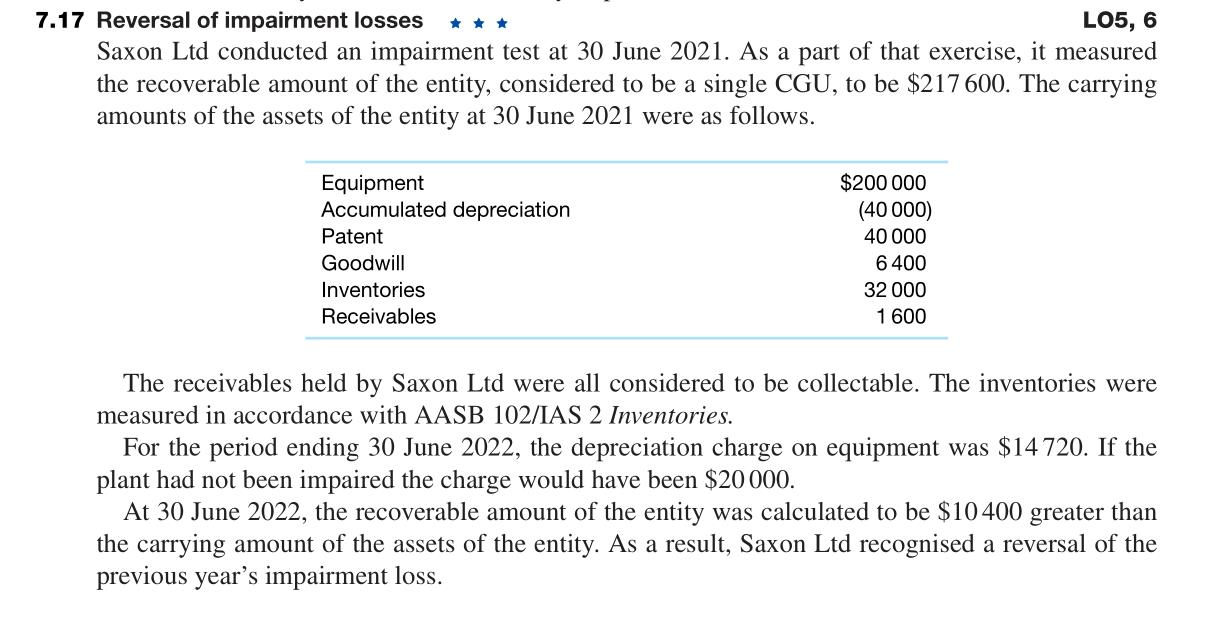

Solved 7 17 Reversal Of Impairment Losses Lo5 6 Saxon Chegg Com

Ias 36 Impairment Of Assets Summary 2021 Youtube

Chapter 11 Depreciation And Impairments Ppt Video Online Download

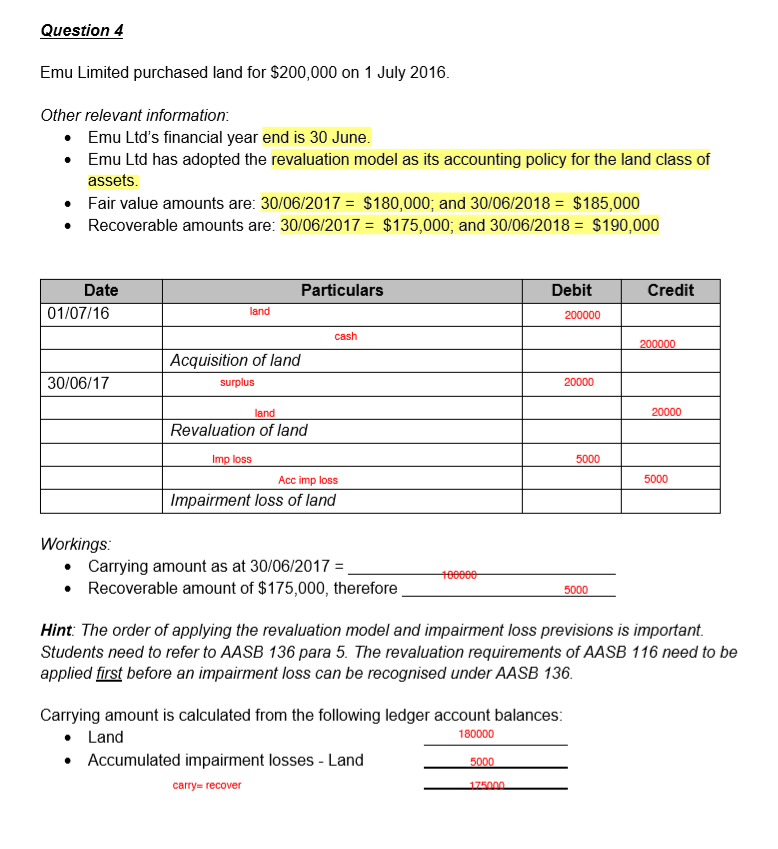

Solved Chapter 7 Impairment Of Assets Application And Chegg Com

Ifrs Ias 36 Reversing Impairment Losses Grant Thornton Insights

Ias 36 Eng Video 4 Reversal Youtube

Solved Date Particulars Debit Credit 30 06 18 Acc Imp Loss Chegg Com

Aasb 136 Impairment Of Assets Aasb 136 Ias 36 Impairment Of Assets Week 2 Solution Reversal Of A Studocu

Solved 7 18 Cgus Reversal Of Impairment Losses 05 6 The Chegg Com

Chapter 9 Impairment Of Assets Ppt Download

Ifrs Ias 36 Reversing Impairment Losses Grant Thornton Insights

Impairment Of Assets Definition In Us Gaap Ifrs Effect

12 1 Chapter 12 Intangible Assets Intermediate Accounting

11 1 Chapter 11 Depreciation Impairments And Depletion

Impairment Loss Application Reiborn

Ifrs Ias 36 Reversing Impairment Losses Grant Thornton Insights

Reversal Of Impairment Losses Annual Reporting

Solved Exercise 15 25 Reversal Of Impairment Losses At 30 Chegg Com